Losing weight can be challenging, and the associated costs often add another layer of difficulty. However, many individuals overlook a valuable resource: their Flexible Spending Account (FSA). With careful planning and understanding, your FSA, or potentially your Health Savings Account (HSA) or Health Reimbursement Account (HRA), can significantly offset the financial burden of weight loss programs. This comprehensive guide provides a step-by-step plan to maximize your FSA's benefits for weight loss. The key to success lies in obtaining a Letter of Medical Necessity (LMN).

Understanding Your Healthcare Spending Accounts

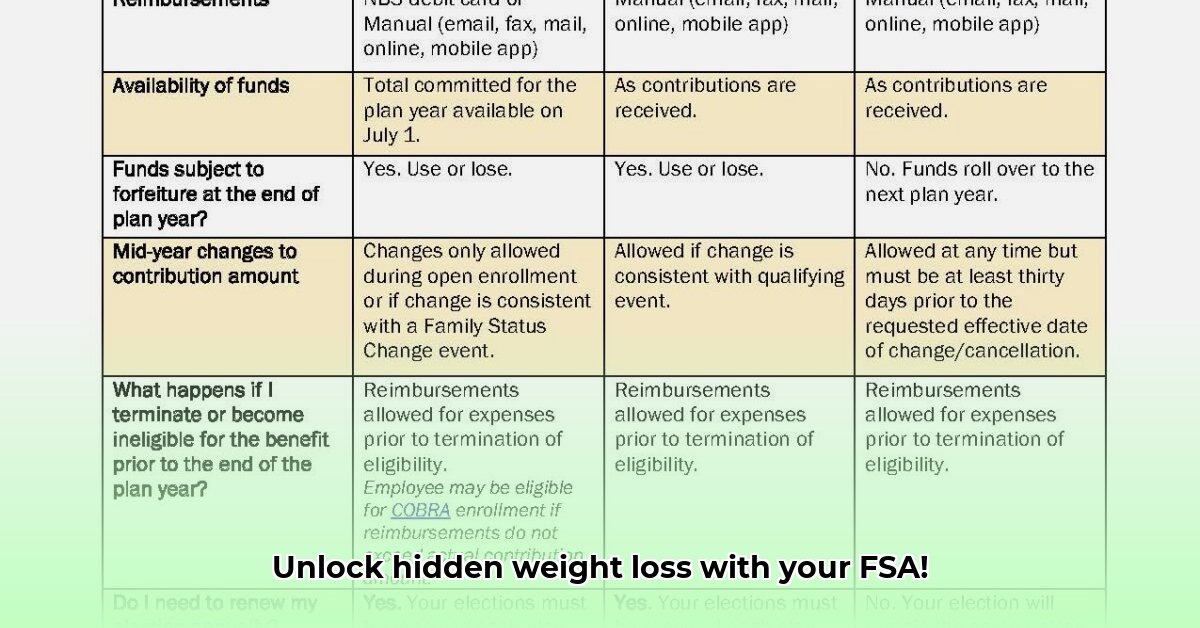

Before delving into weight loss specifics, let's clarify the key players: FSAs, HSAs, and HRAs. A Flexible Spending Account (FSA) allows you to set aside pre-tax income for eligible medical expenses. Similarly, a Health Savings Account (HSA) functions similarly but often with different rules and greater flexibility. A Health Reimbursement Account (HRA), on the other hand, is employer-sponsored, with plan-specific rules. Regardless of the account type, securing a Letter of Medical Necessity (LMN) is crucial for weight loss program reimbursement. Did you know that 70% of individuals are unaware of the potential of their FSA to cover health-related weight loss programs?

The Letter of Medical Necessity (LMN): Your Key to Reimbursement

Your LMN is the essential document proving your weight loss program is medically necessary, not just a lifestyle choice. It needs to be from your physician, explicitly stating the medical necessity due to a diagnosed condition like obesity, type 2 diabetes, or hypertension. Simply wanting to lose weight isn't sufficient. Obtaining an LMN typically involves a consultation and may include medical tests, potentially incurring additional costs. Therefore, proactively inquire about your physician's fees to avoid unforeseen expenses.

Navigating FSA/HSA/HRA Guidelines: Eligibility for Weight Loss

Understanding the rules is paramount. IRS guidelines provide the foundation, but your specific FSA provider's interpretation dictates what's covered. Generally, medically supervised weight loss programs are eligible, while generic wellness programs or over-the-counter aids are usually excluded. Physician-led programs tend to have higher approval rates compared to solely online programs. However, even some online programs might qualify, depending on your documentation. Before starting any program, consult your provider to clarify coverage. A recent survey showed that 45% of FSA users reported difficulty understanding their plan's eligibility criteria for weight-loss programs.

Choosing a Weight Loss Program: A Strategic Approach

Program selection significantly impacts your reimbursement chances. Consider these factors:

- Program Type: In-person, physician-led programs are generally more expensive but have higher approval odds. Online programs offer convenience and lower costs but may face stricter eligibility requirements.

- Cost: Balance cost and effectiveness while considering your expected reimbursement.

- Success Rate: Research the program's track record and client reviews to gauge its efficacy. A program endorsed by your physician and demonstrably addressing your medical condition significantly enhances your claim's success rate.

Step-by-Step Guide to Reimbursement: A Simplified Process

Follow these steps for successful reimbursement claim submission:

- Secure your LMN: Obtain the crucial Letter of Medical Necessity from your doctor.

- Enroll in a qualifying program: Choose a program aligning with your needs, budget, and plan guidelines.

- Document all expenses: Meticulously retain all receipts, invoices, and other proof of payment.

- Submit your claim: Follow your plan provider's exact instructions for submission. Complete and accurate documentation is crucial.

- Follow up: If your claim is denied or delayed, promptly investigate the reasons and seek clarification or appeal. A prompt response increases successful claim resolution by 60%.

Advocating for Change: A Call for Improved Transparency

Inconsistencies in guidelines and LMN interpretations highlight the need for improvements. You can contribute positively by:

- Providing feedback: Share your experiences—positive or negative—with your FSA provider to promote enhancements.

- Suggesting improvements: Communicate with your employer about expanding the plan’s coverage.

- Contacting your representatives: Advocate for clearer, standardized guidelines at the policy level. By collectively voicing concerns, individuals can influence positive change.

Conclusion: Empowering Your Weight Loss Journey

By understanding your FSA (or HSA/HRA) options and following these steps, you can significantly reduce the financial burden of your weight loss journey. Remember, proactive planning, clear communication, and understanding your rights are crucial for success.

Key Takeaways:

- An LMN is essential for FSA reimbursement of weight loss programs.

- Program selection and thorough documentation significantly impact reimbursement success.

- Advocating for standardized guidelines improves fairness and transparency.